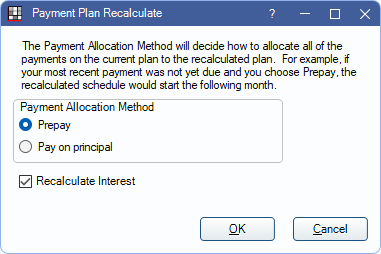

Payment Plan Recalculate

If a patient makes a payment to an Old Payment Plan that is intended as an early payment (before the payment plan amount is due) or a payment to principal, future payments and interest can be recalculated.

In an Old Payment Plan, under Terms, click Recalculate.

Old Payment Plans, formerly Patient Payment Plans, are a deprecated feature. Additional Old Payment Plans cannot be created. Existing Old Payment Plans can still be edited and payments can be attached to these plans. See Payment Plan to create new patient repayment plans.

Enter the payment. See Payment to a Payment Plan.

In the Account Module, double-click the original payment plan. The payment will show as an line item in the amortization schedule.

Under Terms, click Recalculate.

Select how payment should be allocated.

- Prepay: The amount will be applied to future amounts due (e.g. towards the next due payment).

- Pay on Principal: The amount will be subtracted from the total balance, then remaining charges will be recalculated.

To also recalculate interest, check the Recalculate Interest box.

Click OK to recalculate payments.

Late Payments: Interest can also be recalculated for early or late payments. It does not matter which allocation method the user chooses.

- If the user does recalculate interest, the accrued interest is added to outstanding interest amounts then recalculated.

- If the user does not recalculate interest, the accrued interest is added to the next payment; the outstanding amounts remain the same.

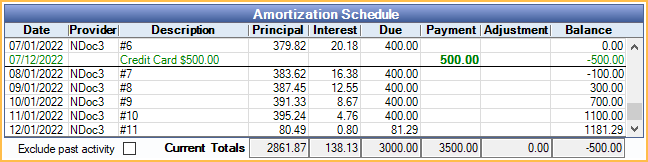

Example

Patient has a $4500 payment plan that had a $0 balance as of 07/01/2022. Their next payment of $400 is not due until 08/01/2022. On 07/12/22, they made a payment of $500, making the payment plan balance $-500.

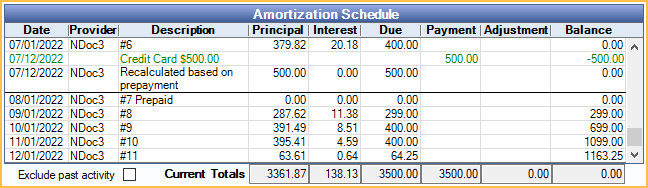

If Prepay is selected as the Payment Allocation Method and interest is also recalculated, the prepayment will be applied to future payments (e.g., payment #7). Any payments that were paid in full, will be noted Prepaid.

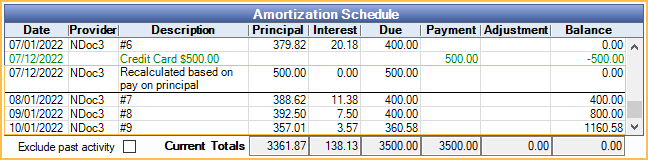

If Pay on principal is selected as the Payment Allocation Method and interest is also recalculated, the prepayment will first subtract from the total balance. Then the remaining payments will be recalculated based on the new balance (new balance / remaining payments = new due amounts). This may change the total numbers of payments or last payment date of the payment plan.

Troubleshooting

A patient has not paid their balance for more than one month and I want to recalculate interest.

When you recalculate, it will only recalculate the interest for the balance at time you recalculate; it will not take into account more than one month.