Insurance Aging Report

The Insurance Aging Report is useful for viewing a breakdown of insurance and patient portion estimates by age of account.

In Standard Reports, in the Monthly section, click Insurance Aging Report.

Offices that want to ensure they are getting paid by insurance companies and want to follow up on older claims should use the Outstanding Insurance Claims Report instead.

This report is based on the guarantor's billing type, primary provider, and clinic. Aging is automatically recalculated when the report is generated.

- To control user access to reports, see Report Setup: Security Permissions.

- Determine default settings for the report with Wrap columns when printing andShow PatNum in Report Setup: Misc Settings.

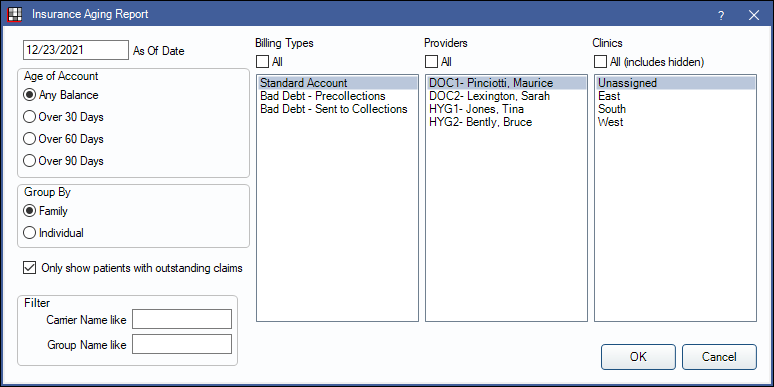

Filters

Set the report criteria and filters before running the report.

As Of Date: Enter the as of date for the report. Defaults to the date of the most recent aging calculation (usually today). If changed to a historical date, totals reflect all transactions up to the date entered except for estimated write-offs.

Age of Account: Select which patients to include based on aging balance.

- Any Balance: Include patients with any balance due.

- Over 30 Days: Include all patients with any balances that are over 30 days due.

- Over 60 Days: Include all patients with any balances that are over 60 days due.

- Over 90 Days: Include all patients with any balances that are over 90 days due.

Group By: Select how to group calculation amounts.

- Family: Group by family, listed by guarantor. Only shows guarantor and family totals, even if insurance plans differ.

- Individual: Group by individual patient.

Only show patients with outstanding claims:

- Checked: Limit report to patients with outstanding claims and enable insurance breakdown options below. Results are grouped by both carrier name and group name.

- Unchecked: Display all patients, regardless of whether they have outstanding claims.

Filter: Insurance breakdown options. Only available when Only show patients with outstanding claims is checked.

- Carrier Name like: Type an insurance carrier name to limit the report results.

- Group Name like: Type an insurance plan group name to limit report results.

Billing Types: Highlight the billing types to include or check All to include all billing types.

Providers: Highlight the primary providers to include or check All to include all providers, including those marked Hidden on Reports.

- When Group By is set to Family, filters by guarantor's primary provider.

- When Group By is set to individual, filters by patient's primary provider.

- To exclude hidden providers from the report, manually select visible providers from the list.

Clinics: Clinics: Select clinics to include in the report. Check All (includes hidden) to include all clinics, including those marked hidden.

- When Group By is set to Family, filters by the guarantor's assigned clinic. When Group By is set to Individual, filters by the patient's assigned clinic.

- If user is restricted to specific clinics, only accessible clinics are listed. When checking All (includes hidden), results include all clinics user has access to, including those marked hidden; results do not include clinics user is restricted from or patients not assigned to a clinic.

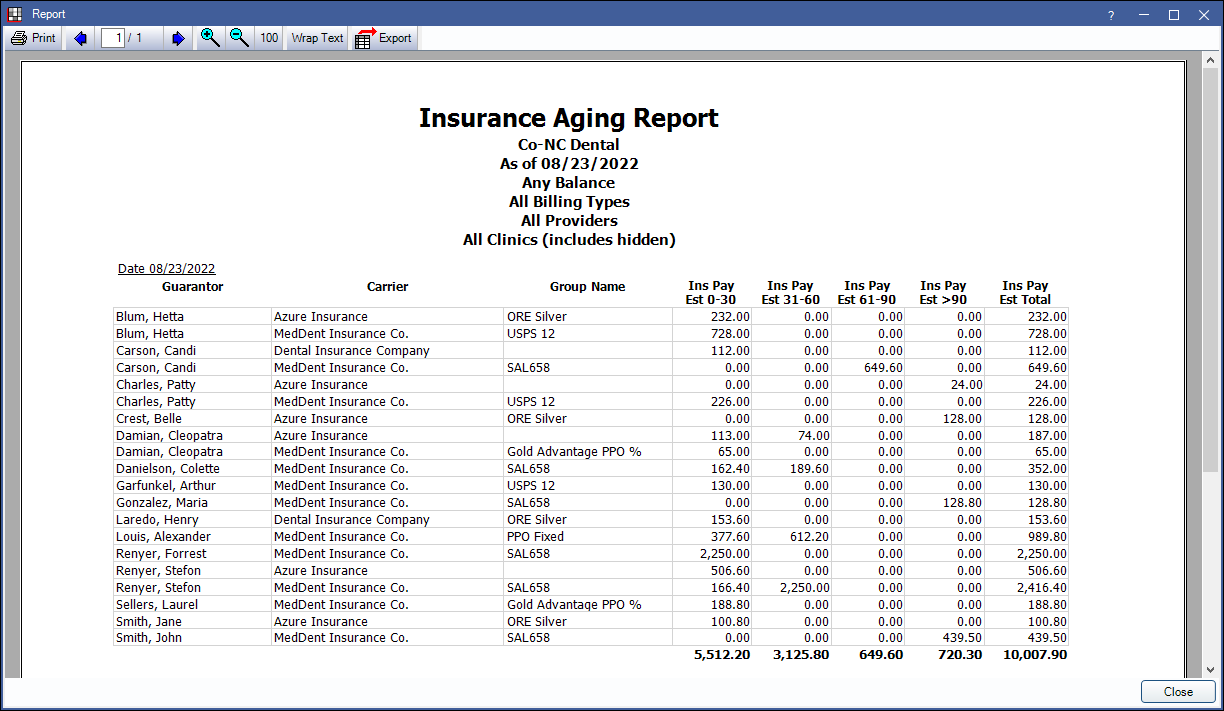

Report Preview

Click OK to generate the report. The resulting report changes depending on if Only show patients with outstanding claims is checked. Below are example reports and explanation of report columns.

Report, run by individual, with Only show patients with outstanding claims unchecked:

Report, run by family, with Only show patients with outstanding claims checked:

The columns vary depending on the report criteria.

- Guarantor or Patient:

- When grouping by Family the last name and first name of the guarantor of a family. Subsequent columns for the row reflect family balances.

- When grouping by Individual the last name and first name of an individual patient. Subsequent columns reflect individual patient balances.

- The following columns only appear on the report when Only show patients with outstanding claims is checked:

- Carrier: Insurance carrier associated with the outstanding insurance estimate.

- Group Name: Group name of the insurance plan associated with the outstanding insurance estimate.

- Ins Pay 0-30 Days: The estimated insurance balance that is 30 days past due.

- Ins Pay 31-60 Days: The estimated insurance balance that is 31-60 days past due.

- Ins Pay 61-90 Days: The estimated insurance balance that is 61-90 days past due.

- Ins Pay > 90 Days: The estimated insurance balance that is greater than 90 days past due.

- Ins Est Total: The total of any outstanding insurance estimates. This includes Claim Procedures ( claimprocs ) with a status of Not Received and Pending Supplemental Insurance Overpayments/Underpayments.

- The following columns only appear when Only show patients with outstanding claims is unchecked:

- Pat Est 0-30 Days: The patient estimated balance up to 30 days past due.

- Pat Est 31-60 Days: The patient estimated balance 31-60 days past due.

- Pat Est 61-90 Days: The patient estimated balance 61-90 days past due.

- Pat Est > 90 Days: The patient estimated balance greater than 90 days past due.

- Pat Est Bal Total: The total patient estimated balance.

- W/O Change: The difference between the original write-off estimate and the current write-off estimate (if changed) for unreceived claims.

- Pat Est Amount Due: The total amount estimated to be owed by patient after insurance estimates and changes in write-offs. This is based on the total account balances and not only outstanding claims (i.e. Pat Est Amount Due = Total Account Balance - Ins Pay Total - Write-offs).

Report Logic

Insurance payment estimate (Ins Pay) columns are based on the Claim Snapshot and include estimated write-offs. If any change is made that affects the estimated write-off, this is reflected in the W/O Change column only.

Patient estimated balances (Pat Est) columns are based on the Total Account Balance, this amount is not on the report, minus insurance payment estimates from the Claim Snapshot (e.g., Pat Est >90 = Total Account Balance - Ins Pay Est >90)

This report does not exclude accounts with negative balances.